INTRODUCING THE 2024 CATEGORY CAPTAINS

DIVERSITY AND INCLUSION PROGRAMS IN THE C-STORE INDUSTRY FACE OBSTACLES

INTRODUCING THE 2024 CATEGORY CAPTAINS

DIVERSITY AND INCLUSION PROGRAMS IN THE C-STORE INDUSTRY FACE OBSTACLES

DIVERSITY, EQUITY AND INCLUSION (DEI) programs have long been an area of divisiveness among Americans, but the debate reached a new fever pitch earlier this year when billionaires, Tesla CEO Elon Musk and investor Mark Cuban, engaged in a heated social media battle over the merits of DEI programs, with Musk calling Cuban a “racist” for championing such initiatives.

No matter your position on formal DEI programs, I think almost everyone can agree that:

1. No one should experience bias or be discriminated against in the workplace; and

2. All individuals deserve to feel that they can bring their full selves to work.

Since June 2021, Convenience Store News has been spearheading an industrywide initiative to facilitate engagement among all stakeholders in the channel around diversity and inclusion (D&I). At the time, we were hearing from retailers, distributors and suppliers in the industry that they wanted to make their organizations more diverse and inclusive, but they didn’t know where or how to start. So, we launched this program to be a catalyst for discussion, engagement and action.

In March of last year, we introduced the Convenience Inclusion Initiative to bring together our diversity and inclusion program, and our Top Women in Convenience and Future Leaders in Convenience programs under one umbrella for maximum impact. The mission of

EDITORIAL EXCELLENCE AWARDS (2016-2024)

the Convenience Inclusion Initiative is to champion a modern-day convenience store industry where current and emerging leaders foster an inclusive work culture that celebrates differences, allows team members to bring their whole selves to work, and enables companies to benefit from diversity of thought and background — in short, an industry for all.

This year, we’re expanding the Convenience Inclusion Initiative by kicking off a year-round campaign under the theme of “Talk. Listen. Understand. Act.”

To keep the momentum going all year long, we feel it’s important to provide, at a minimum, monthly programming. We’ll be diversifying the way we deliver content this year, too. While you will still find columns in the magazine, we’ll also be exploring avenues like videos, podcasts, training sessions, personal stories, workshops, social media, and more.

In this issue, we debut our new Diversity & Inclusion Pulse Study, which will be fielded annually and is designed to investigate the current state of D&I in the industry and capture the sentiments of retailer, distributor, manufacturer and service/solution provider employees and employers at all levels — from the C-suite to the c-store. Turn to page 28 for the findings.

If you have a story to tell, I’m ready to talk and listen. Drop me a line.

For comments, please contact Linda Lisanti, Editor-in-Chief, at llisanti@ensembleiq.com.

Tony

Roy

WARNING: This product contains nicotine. Nicotine is an addictive chemical.

You can’t sell what you don’t stock.

Maximize customer expectations and profit margins by keeping your ZYN inventory full.

Expansion will pit more best-in-class chains against one another in 2024

I think 2024 is shaping up to be the most highly competitive year yet for this exciting industry.

IN THE 15 YEARS I’ve been covering the convenience store industry, one of the things that most fascinated me about the business is the regionalization of the competitive landscape.

With the exception of 7-Eleven and, to a lesser extent at the time, Circle K, you knew that certain states and markets were dominated by a select group of midsized retailers. Eastern Pennsylvania was Wawa country, while the western part of the state belonged to Sheetz. Atlanta was a battleground for RaceTrac and QuikTrip. Parker’s dominated Savannah, Ga., and so on.

Because of that, we always talked about the pros and cons of this fragmented industry. On the one hand, there was no 1,000-pound gorilla (like a Walmart) putting everyone else out of business. Competition in many markets was limited to just a handful of top players. On the other hand, the fragmented nature of the business often resulted in companies lagging behind the larger, more sophisticated retailers with better technology and suffering from a less efficient supply chain (unless they were one of the few like Kwik Trip that were self-distributing).

One would think the industry would have consolidated greatly by now, like other retail channels such as mass merchandisers, drug stores, home improvement warehouses, wholesale clubs, etc. But that hasn’t happened. There has been consolidation at the top, especially among the top three chains, which at last count on the Convenience Store News Top 100 accounted for 14% of the stores in the industry. Nevertheless, the top 10 chains account for only 18% while the top 100 comprise less than a third of the total industry. There are still a lot of c-store companies out there.

What strikes me as most intriguing about today’s c-store landscape is how the expansion of some of the industry’s best-in-class chains is increasingly pitting the best of the best against one another.

That’s not unusual in the Mid-Atlantic, where great companies such as Wawa, Rutter’s, Royal Farms and Dash In already go head to head daily. But now, Wawa, which has already grown a major presence in Florida, has expansion plans for its next 1,000 stores in states like Indiana, Kentucky, Ohio, North Carolina and Alabama. What impact will Wawa have on Family Express in Indiana or Thorntons in Kentucky or United Dairy Farmers in Ohio?

Sheetz recently opened a new food prep and distribution facility in Ohio to support its expansion there and in Michigan. It will be interesting to watch the Sheetz vs. Wawa competition in Ohio and North Carolina.

RaceTrac is opening its first stores in South Carolina this year, setting up interesting battles with Parker’s, which is expanding from its Georgia base. Atlanta-based RaceTrac is also targeting Ohio this year, joining Wawa and Sheetz in zeroing in on The Buckeye State.

No one ever said that the c-store industry wasn’t a competitive business. But I think 2024 is shaping up to be the most highly competitive year yet for this exciting industry.

For comments, please contact

Don Longo, Editorial Director Emeritusat dlongo@ensembleiq.com.

FEATURES

COVER STORY

28 Taking the Pulse of D&I Diversity and inclusion programs in the c-store industry face obstacles.

FEATURE

46 Helping C-stores

Survive the Headwinds

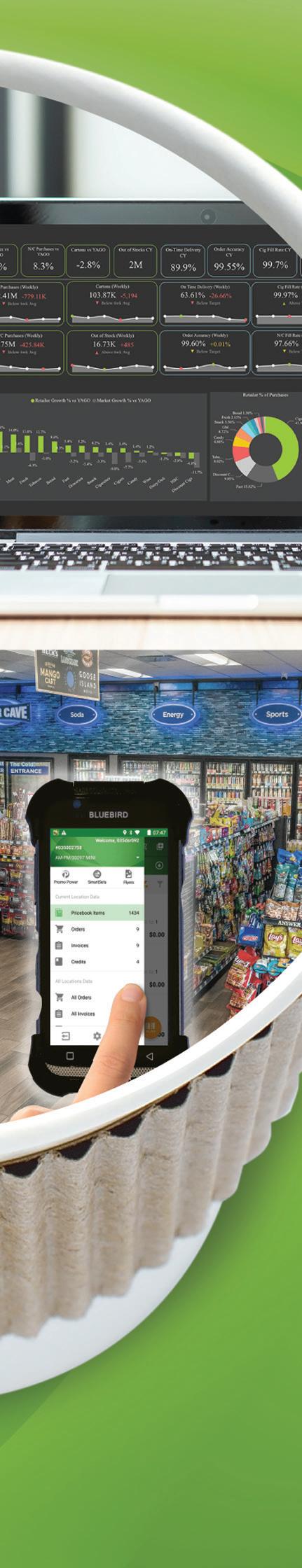

This year’s Category Captains awards honor 16 agile suppliers and distributors.

NOTE

VIEWPOINT

6 Worlds Colliding Expansion will pit more

12

4 Finding Common Ground Convenience Store News expands the Convenience Inclusion Initiative.

chains against one another in 2024.

SMALL OPERATOR

24 Country Pride

STORE SPOTLIGHT

Double D Market leans into its roots and focuses on strong customer connections.

63 Easy Come, Easy Grab & Go

A new autonomous ampm store at San Francisco’s Chase Center helps hungry fans get back to their seats — and the game — quicker.

INSIDE THE CONSUMER MIND

82 Value Seekers

A positive c-store shopping experience increasingly means reasonable prices.

CATEGORY

14 U.S. C-store Count

Sees Second Consecutive Year of Growth

16 Fast Facts

18 Retailer Tidbits

19 Supplier Tidbits

20 Eye on Growth TECHNOLOGY

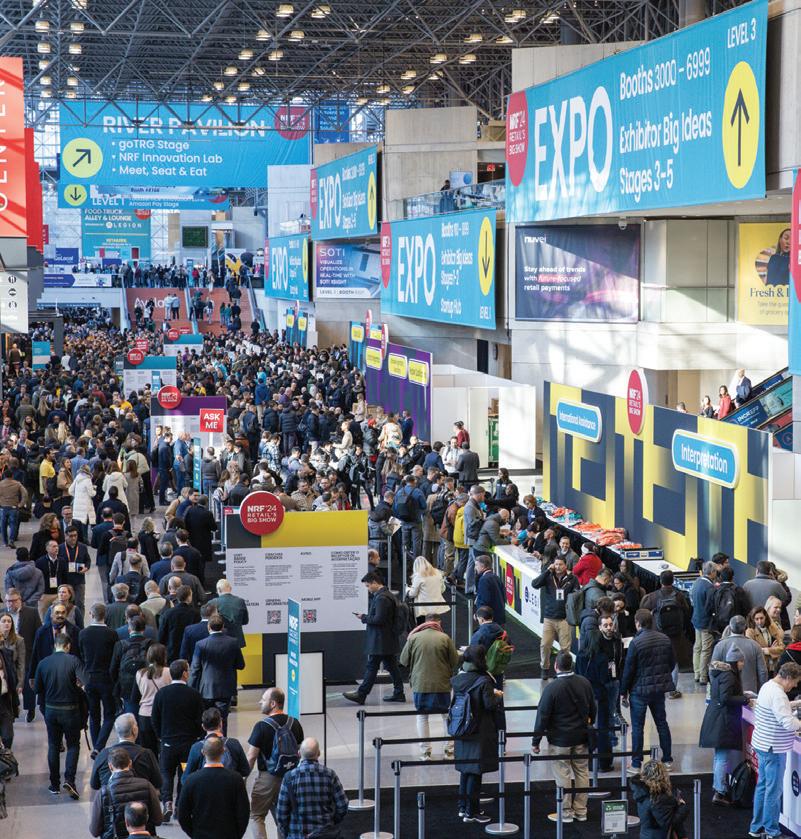

61 Ramping Up the Customer Experience Retailers and technology solution providers came together at NRF 2024: Retail’s Big Show to share insights on providing a seamless shopping journey.

TOBACCO

34 Braced for a Slowdown

The tobacco segment that once ruled the backbar is under increasing pressure.

FOODSERVICE

37 Mastering Foodservice Marketing

From limited-time offers to billboards, convenience store retailers are getting the word out about their high-quality food offerings and boosting profits.

ALCOHOLIC BEVERAGES

43 Building a Better Beer Identity Product curation and creative initiatives can put c-stores top of mind with shoppers.

8550 W. Bryn Mawr Ave., Ste. 225, Chicago, IL 60631 (773) 992-4450 Fax (773) 992-4455 WWW.CSNEWS.COM

BRAND MANAGEMENT

SENIOR VICE PRESIDENT-GROUP PUBLISHERUS GROCERY & CONVENIENCE GROUP Paula Lashinsky (917) 446-4117 - plashinsky@ensembleiq.com

EDITORIAL EDITOR-IN-CHIEF Linda Lisanti llisanti@ensembleiq.com

EXECUTIVE EDITOR Melissa Kress mkress@ensembleiq.com

SENIOR EDITOR Angela Hanson ahanson@ensembleiq.com

MANAGING EDITOR Danielle Romano dromano@ensembleiq.com

ASSOCIATE EDITOR Amanda Koprowski akoprowski@ensembleiq.com

EDITORIAL DIRECTOR EMERITUS Don Longo dlongo@ensembleiq.com

CONTRIBUTING EDITORS

Renée M. Covino, Tammy Mastroberte

ADVERTISING SALES & BUSINESS

ASSOCIATE BRAND DIRECTOR & NORTHEAST

SALES MANAGER Rachel McGaffigan - (774) 212-6455 rmcgaffigan@ensembleiq.com

ASSOCIATE BRAND DIRECTOR & WESTERN SALES MANAGER

Ron Lowy - (330) 840-9557 - rlowy@ensembleiq.com

ACCOUNT EXECUTIVE & CLASSIFIED ADVERTISING

Terry Kanganis - (201) 855-7615 - tkanganis@ensembleiq.com

DESIGN/PRODUCTION/MARKETING

ART DIRECTOR Lauren DiMeo ldimeo@ensembleiq.com

PRODUCTION DIRECTOR Pat Wisser pwisser@ensembleiq.com

SENIOR MARKETING MANAGER Krista-Alana Travis ktravis@ensembleiq.com

SUBSCRIPTION SERVICES

LIST RENTAL mbriganti@anteriad.com

SUBSCRIPTION QUESTIONS contact@csnews.com

CORPORATE

Subsidiaries of Utz Brands Inc., including Utz Quality Foods LLC, entered into a definitive agreement to sell certain assets and brands to Our Home, an operating company of brands that includes Real Food From the Ground Up, Popchips and Food Should Taste Good. The transaction comes with a $182.5 million price tag.

2

Several Vuse menthol vapor products will remain on the market despite a marketing denial order from the U.S. Food and Drug Administration as the U.S. Court of Appeals for the Fifth Circuit decides on the merits of the case, which is likely to take a significant amount of time.

Data analytics firm Placer.ai named Foxtrot Market one of the Top 10 Brands to Watch in 2024, placing it in the company of such major brands as New Balance and Trader Joe’s. Factors for its selection included steady growth, the retailer’s recent merger with Dom’s Kitchen & Market and the company’s focus on local brands.

Joe Cruz of Lincoln, Neb., was selected from 500-plus qualified candidates to serve as the authority on sampling, researching and pairing Casey’s pizzas with the best beer combinations. He will create compelling social media content to inform Casey’s Country about these unique pairings and attend public events to spread the passion for pizza and beer.

Shell Mobility Co. Operations LLC is expanding its operated retail presence into New Mexico through the acquisition of Brewer Oil Co.’s retail division. The deal comprises convenience stores, cardlocks for fleet vehicles, and traditional fueling stations.

EXPERT VIEWPOINT

The value of sports fans isn’t just in the sheer number, but also in the cross demographics, according to Bill Nolan, a partner at the Business Accelerator Team, who pointed to multiple advantages that sponsorships can offer a convenience store retailer.

“A state or major city sports venue [allows] a business [to] build a bond with communities through paired loyalties with the local teams,” he said. “Advertising your sponsorship in the business itself will help build consumer awareness that ‘we’re all united by being fans of the same team.’ Having this sponsorship may [also] give you the right to use their team logo, have contests to win tickets [or] wear apparel or other marketing elements provided by the team.”

For retailers making their first forays into sports partnerships, a short-term sponsorship may be easier to handle. If the limited partnership ends up satisfying both the brand and the team, the c-store can always negotiate a longer-term agreement later down the line.

MOST VIEWED NEW PRODUCT

Vandemoortele

Small operators still comprise the majority of the industry at 63%

THE CONVENIENCE store industry continues to grow its presence across the United States. According to the recently released “2024 NACS/ NIQ Convenience Industry Store Count,” there are 152,396 convenience stores currently operating in the U.S., a 1.5% increase from last year.

This year marks the second consecutive year of growth for the industry’s footprint. The convenience channel has experienced store count growth in six of the last 10 years.

Broken down by size, the bulk of U.S. convenience stores are from small, “A-sized” retailers that only operate between one and 10 stores (63%), and the majority of which consist of only a single location. Second are “E-sized” operators with more than 500 stores (21.6%).

Nearly every state increased its store count including Texas, which continues to have the most convenience stores (16,304), or more than one in 10 stores in the country. After losing 53 stores last year, California added 177 back to its store count. Only seven states saw a reduction

in their count: Alaska, Iowa, Idaho, Louisiana, Maine, Oklahoma and Vermont.

Convenience stores sell an estimated 80% of the fuels purchased by consumers in the U.S., according to NACS. The 2024 c-store industry census shows that 120,061 c-stores currently sell fuels — a 1.2% increase over the 118,678 stores that did so in 2023.

While the convenience store industry’s retail presence in local communities is expanding, other brick-and-mortar channels are having more varied experiences. Grocery registered a 0.7% store count decrease, followed closely by drug with a 0.6% decrease. Dollar stores, on the other hand, posted a 3.7% increase in store count.

With the U.S. population at an estimated 336 million, according to the U.S. Census Bureau, there is one convenience store per every 2,204 people in the nation.

The “2024 NACS/NIQ Convenience Industry Store Count” is based on stores in operation as of Dec. 31, 2023.

Caffeine from black and green tea.

Motorists in the United States surpassed 100 billion miles driven on E15 fuel.

— Growth Energy

34% 61%

In a recent survey, 34% of participants said they plan to buy RTD cocktails in the coming year.

— Drizly & BevAlc Insights

61% of Generation Z plan to drink less in 2024, up from 40% last year.

— NCSolutions

BP introduced the Amoco brand to its TravelCenters of America (TA) network. As of early February, the company upgraded 15 TA sites with the new branding and plans to convert 50 more locations before the end of the year.

Texas Born (TXB) is transforming more locations to reflect the brand’s fresh and innovative offerings. Ten TXB convenience stores in south Texas have been upgraded to date, and two of the 10 upgraded stores feature a variety of fresh-made food items.

Enmarket, through a partnership with Liquid Barcodes Inc., introduced a Marketwash mobile app that offers customers monthly subscription car washing options. This is a first-in-the-market program, according to the retailer.

GPM Investments LLC teamed up with Performance Food Group Inc. to launch a new signature pizza program. The offering is available hot at 200 GPM c-stores, and frozen to take-and-bake at more than 1,000 locations.

Family Express Corp. debuted a nextgeneration mobile app experience. Powered by Rovertown, Family Express’ new platform makes it easy to order food, activate a car wash and pay for purchases.

Duck Thru Food Stores is entering the electric vehicle (EV) charging arena. The convenience retailer partnered with FreeWire Technologies to deploy Duck Thru’s first EV charger at a location in Columbia, N.C.

Bidi Vapor LLC is challenging the U.S. Food and Drug Administration’s marketing denial order (MDO) for its tobaccoflavored Classic BIDI Stick electronic nicotine delivery system device. Bidi Vapor filed a petition requesting that the U.S. Court of Appeals for the Eleventh Circuit review the MDO.

British American Tobacco and Philip Morris International Inc. resolved all ongoing patent infringement litigation related to heated tobacco and vapor products. The settlement prevents future claims against current products and allows each party to innovate and introduce product iterations.

Mars Inc. held a grand opening for a new Global Research and Development Hub on its Goose Island campus in Chicago. The 44,000-square-foot, $42 million facility features a clean nut kitchen, a prototype test kitchen and a product pilot line.

Krispy Krunchy Chicken grew exponentially in 2023, opening 481 new units over the course of the year. The hot food concept is now available in nearly 3,000 locations. The brand also implemented operational improvements, including an expansion of its field support team and adding to its headcount across all departments.

Reynolds American Inc. (RAI) has been named a Top Employer for 2024 in the United States by the Top Employers Institute. RAI was one of 44 organizations nationwide to receive the recognition. This is its second consecutive year making the list.

Five Star Food Service rebranded to Five Star Breaktime Solutions. The name change represents the company’s commitment to delivering a wide range of custom solutions focused on enhancing breaktime experiences and fostering employee wellbeing.

Krispy Krunchy Chicken launches its new Cajun Chicken Sandwich, a premium-quality sandwich that is crispy on the outside but juicy on the inside. The sandwich features an all-white-meat breast filet marinated in Krispy Krunchy’s mild Cajun spices, coated in the company’s proprietary breading, topped with honey sauce and two pickles, and served between a sliced brioche bun. The new Cajun Chicken Sandwich comes with a suggested retail price of $4.99 in most locations. Over the next few months, the brand intends to give customers a sneak peek of the new offering through sampling events in various cities.

KRISPY KRUNCHY CHICKEN • ALEXANDRIA, LA. • KRISPYKRUNCHY.COM

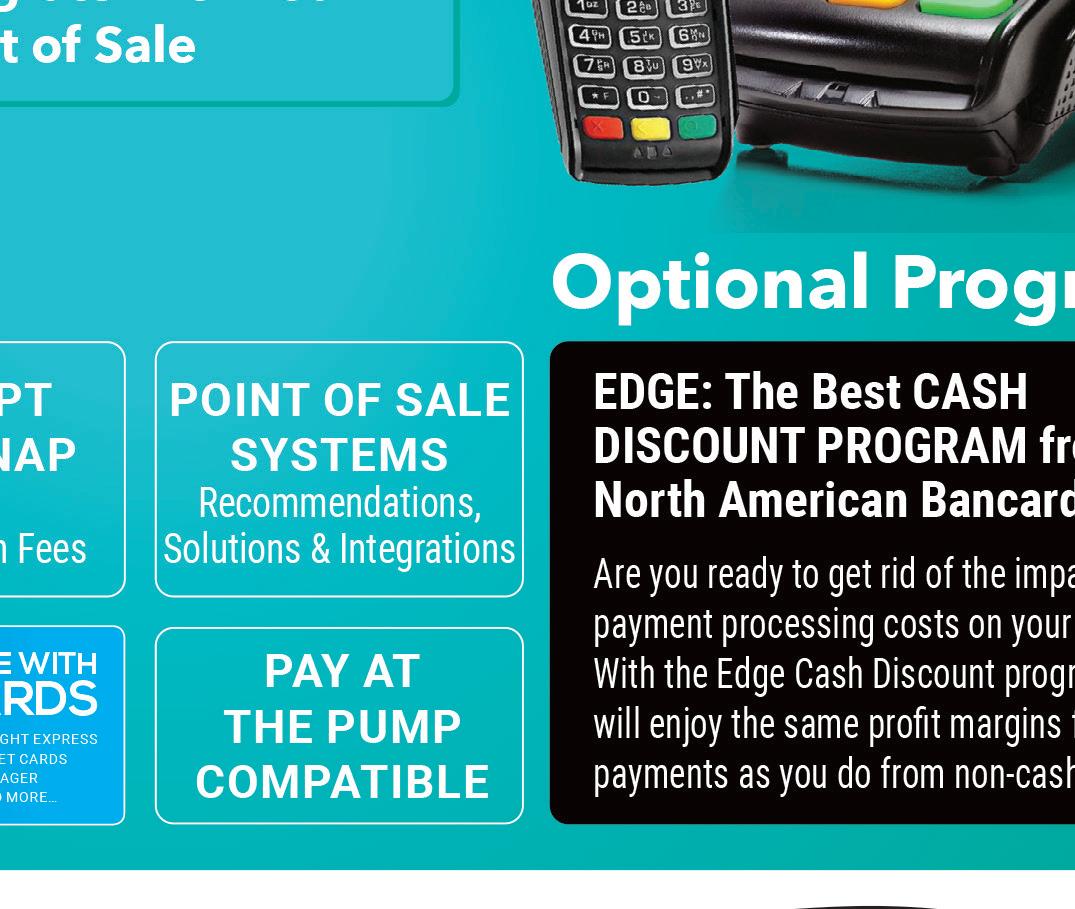

Energy drink brand Celsius debuts its newest bubble-free offering: Fizz-Free Blue Razz Lemonade. A highly requested noncarbonated flavor, the beverage combines sweet raspberry notes with a crisp citrus finish, and combines premium ingredients with seven essential vitamins and zero sugar. Celsius Fizz-Free Blue Razz Lemonade is available exclusively at 7-Eleven Inc. stores for the first six months of 2024 before moving into wider retail distribution. The suggested retail price per can is $2.39. The brand plans to relabel its other existing noncarbonated beverages — Peach Mango Green Tea and Raspberry Açai Green Tea — as Celsius Fizz-Free as well. CELSIUS HOLDINGS INC. • BOCA RATON, FLA. • CELSIUS.COM

Rich Products Corp. presents the Funfetti Individual Cheesecake Slice, an individually packaged treat that can be sold retail-ready or ready to serve. Each portioned slice is filled with colorful candy bits and birthday cake flavor, and covered with a drizzle of decorative white icing. According to Rich’s, Funfetti has doubled in growth from 2019 to 2022 into a $105 million brand, making it a good choice for convenience store retailers looking to target the millennial and Gen Z demographics. Each slice is 3.25 ounces and comes 24 per case, with a frozen shelf life of 365 days.

RICH PRODUCTS CORP. • BUFFALO, N.Y. • RICHSUSA.COM

In partnership with Horton Automatics, merchandising and display equipment provider Anthony introduces an all-new Automatic Beer Cave Door for walk-in coolers. The product features a motion sensor on the interior and exterior, allowing for easy two-way traffic, along with a heavy-duty drive train tested to 1 million cycles, helping to ensure longevity. The Anthony Automatic Beer Cave Door is available in six sizes with either single or double-door configurations, and features anti-condensate sweat protection. Full-service installation by a Horton certified dealer is included.

ANTHONY INTERNATIONAL • SYLMAR, CALIF. • ANTHONYINTL.COM

New from Dover Fueling Solutions (DFS), DX Promote Auto is a managed media service that provides fuel and convenience retailers with advertising content to display on the DFS Anthem UX platform. The service provides access to a dedicated team that manages and creates custom, site-specific advertising, short-form infotainment, national promotions and major oil content, giving retailers more time to prioritize the supervision of daily operations. To ensure retailers receive their preferred content, DFS additionally includes a customer intake form for banner ads on a quarterly basis, allowing operators to select content based on relevance and value.

DOVER FUELING SOLUTIONS • AUSTIN, TEXAS • DOVERFUELINGSOLUTIONS.COM

Morinaga America Inc. expands its Hi-Chew brand with the addition of Hi-Chew Dessert Mix. The offering combines the candy’s chewy texture with classic dessert-inspired flavors, such as the creamy and sweet Strawberry Ice Cream; lime-forward Key Lime Pie, complemented by subtle hints of graham cracker crust; and tangy, crisp Candy Apple. All of the flavors in the Hi-Chew Dessert Mix provide a double layer of true-to-life flavor, are gluten free and contain no colors from synthetic sources. Peg bags are currently available exclusively at select 7-Eleven and Speedway locations nationwide, while standup pouches are available now to retailers throughout the country.

MORINAGA AMERICA INC. • IRVINE, CALIF. • HI-CHEW.COM

Enhanced water brand Lemon Perfect brings to market a larger bottle size and three new permanent flavors: Watermelon, Coconut and Blueberry. According to the company, due to the positive response to its limited launch of the watermelon flavor in summer 2023, the brand is adding it to the permanent lineup along with coconut and blueberry varieties. A new 15.2-ounce bottle will replace the original 12-ounce size across all retail channels, allowing Lemon Perfect to fit on shelf space in convenience stores at a better value.

THE LEMON PERFECT CO. • ATLANTA • LEMONPERFECT.COM

Diamond of California, in partnership with Nature Nate’s Honey Co., is offering Hot Honey Snack Walnuts, a new sweet and spicy superfood snack. The Californiagrown walnuts contain protein, fiber and ALA Omega-3, while the light Nature Nate’s Hot Honey glaze is 100% pure honey infused with chili peppers. The offering will soon replace a previous Hot Honey recipe sold in yellow packaging at major retailers. Each 4-ounce bag has a suggested retail price of $3.99. The new flavor joins Diamond’s four other varieties: Salted Dark Chocolate, Himalayan Pink Salt, Sweet Maple and Pecan Pie Snack Pecans.

DIAMOND OF CALIFORNIA • STOCKTON, CALIF. • DIAMONDNUTS.COM

Partner Tech USA Inc. unveils the Mini Bora Bora, a hybrid point-of-sale and self-checkout solution that is appropriate for use in convenience stores. The base swivels 270 degrees to accommodate both self-checkout and assisted checkout, while a compact design and hidden cable compartment in the base keeps counters clutter free. The Mini Bora Bora supports two independent displays and has an integrated thermal printer, a 2-D barcode scanner and a 21.5-inch touch display. Available as either a Windows or Linux based computer, the system comes in several different colors that can be customized to match a retailer’s brand.

PARTNER TECH USA INC. • ANAHEIM, CALIF. • PARTNERTECHCORP.COM

Fuel software developer Titan Cloud introduces Fuel Asset Optimization, a software platform designed to deliver a consolidated view of vital data to manage risk and fuel profit in real time. The program aims to connect people, equipment and facilities in the convenience store, fleet and service provider markets to reduce compliance risk, decrease maintenance costs and increase revenues by drawing on data from automatic tank gauges, dispensers and other transactional or third-party systems. Key product highlights include enterprisewide visibility, insight and access control; a centralized data source; fuel analytics and automation; and a scalable platform.

TITAN CLOUD • NASHVILLE, TENN. • TITANCLOUD.COM

IT DOESN’T HAVE a mobile app, drive-thru or self-checkout. There is no beer cave on the premises. But what is absent is part of the simple plan and allure of Double D Market, located at the intersection of Highways D and DD in Defiance, Mo.

“We are a dying breed, but I hear from my regulars very often how much they appreciate the small ‘mom and pop’ feel and the service they receive,” Mary Jo Keevan, co-owner of the 2,200-squarefoot single store, told Convenience Store News. “They tell us all the time, ‘Please don’t change.’ They want that ‘good old days’ kind of atmosphere. Change is inevitable, but not always the preferred option, thankfully.”

And so, Double D Market puts an emphasis on its country pride. Patrons are greeted in-store by a sign that reads, “A Day in the Country is Worth A Million in Town!”

When Keevan or her co-owner Debbie Groesch is working, country oldies songs can often be heard playing throughout the store. “Customers come to the counter singing. We send them off with a smile on their face,” she said.

Accompanying the ambiance is down-home cooking, particularly Double D’s hot breakfast sandwiches, which are made every morning in its kitchen. The store opens at 4:30 a.m. on weekdays and 5:30 a.m. on weekends to get breakfast started early. About 100 breakfast sandwiches are sold each day, sometimes more.

“Nothing is microwaved,” Keevan proudly notes.

Another customer favorite is the store’s homemade mini loaves of banana bread. Deli sandwiches are made fresh every day, too. Double D Market closes at 9 p.m. daily.

The store boasts a full line of groceries and “a good selection” of frozen goods, according to Keevan. “Our customers appreciate that we have a little of everything,” she said.

“Everything” includes nightcrawlers and fishing lures and a pancake flipper, to name just a few of the options. The store caters to customers of the nearby August A. Busch Memorial Conservation Area, with numerous fishing lakes located just a couple of miles down Highway D.

Of course, like every convenience store operator these days, the owners of Double D Market face some challenges. Keevan explained that one of the business’ biggest obstacles is part of its charm: the building

itself, which was built in the 1940s as a combination store/tavern, with a baseball diamond and horseshoe pits out back.

Old, dated features have needed attention. “We have slowly been replacing equipment, including an ancient beast of a freezer, which we had to cut into pieces to remove,” she said.

Double D is limited on the fuel side of the business as well, handicapped by its small lot. It has four fueling positions and not enough room to add more pumps.

“We also wish we could sell diesel fuel, but we only sit on a little over an acre. Selling fuel is itself a big question mark with margins never being consistent,” said Keevan. “Considering it’s close to three-fourths of every dollar we take in, we have to make sure to draw our customers inside. Our hot breakfast sandwiches do that.”

Just as Double D Market has strong roots in the community, Keevan has strong roots in the convenience store business. In 1973, when she was a senior in high school, her parents built and opened a convenience store on Highway K in O’Fallon, Mo.

“I was one of eight kids and we all worked [there],” she recalled. “I purchased that business, the K-Shop, in 1992. I considered my dad a very smart businessman, and I learned a lot from him.”

The now Double D Market came up for sale in 2002. It was previously named Friedly’s Market. The previous owners, Don and Jane

Friedly, were well-liked in the community and had run the business for approximately 25 years.

“I was familiar with the store and loved its country location. In 2002, the Friedlys were eager to move on and the sale happened quickly,” Keevan explained. “A good friend of mine became co-owner and we officially became the Double D Market in June of that year. In 2004, after selling the K-Shop, we expanded the Double D: moved walls, added a beer cooler and additional shelving, and started selling deli sandwiches and our hot breakfast sandwiches.”

Now in their late 60s, Keevan and her partner are starting to think about retiring and “looking for that next person to take over and love getting to know their customers and keeping things pretty simple.”

Does she believe their concept will continue to work in the future?

“I think community c-stores like ours will always survive because we offer what you just don’t find in retail of any other kind. It’s about great personal service, when someone knows your name and greets you as you walk through the door. Our customers are our friends; their kids work for us,” she said. “If you forgot your wallet, no problem. If you’re home sick and need a delivery, we got it. It’s all about being good neighbors and it works both ways.”

At the core of Double D’s community success is its staff. “We rely on our employees and are blessed to have very good ones,” said Keevan. “They take our lead, getting to know customers by their names and taking care to keep them happy.

“I love teaching our staff about the c-store business and how it works. I believe it makes the job more interesting,” she added, acknowledging that it would be nice to lease the business to an employee, teaching them what it’s taken her years to learn and love. CSN

DIVERSITY AND INCLUSION (D&I) programs are slow going in the U.S. convenience store industry, according to a new Diversity & Inclusion Pulse Study conducted by Convenience Store News

The study, which will be fielded annually, is designed to investigate the current state of D&I in the industry and capture the sentiments of retailer, distributor, manufacturer and service/solution provider employees and employers at all levels — from the C-suite to the c-store.

Only about three in 10 retailer respondents and just shy of four in 10 supplier-side respondents reported that their organization currently has a D&I program in place. Meanwhile, 45% of retailer respondents and 36% of supplier-side respondents said their organizations do not have such a program in place, nor are there any immediate plans to develop one.

Family-owned organizations are significantly more likely to not have a D&I program in place, nor immediate plans to develop one, compared to non-family-owned organizations. The same is true for privately owned companies, compared to publicly owned ones.

The top five reasons for not having or planning to have a D&I program are:

1. Diversity and inclusion are not issues our organization is concerned about.

2. We are already diverse and inclusive; don’t need a formal D&I program.

3. Our organization doesn’t feel it is a corporate responsibility to get involved in D&I issues.

4. Too many higher-priority issues to deal with.

5. Our organization isn’t large enough.

Some respondents strongly oppose any efforts focused on diversity, equity or inclusion (DEI) by an organization. Verbatim comments among this group included:

• “DEI is wrong.”

• “DEI programs are such a clunky, misdirected way to go about this — their focus isn’t on true diversity or inclusion.”

• “Focus on merit-based employment and operations.”

• “Government should stay out of businesses.”

• “Diversity of ideas matter to us, not color of skin, gender or race.”

On the other side of this issue, proponents pointed out that D&I programs have many benefits, including ones that positively impact the bottom line. Among these benefits are a high-performance organization driven by engaged employees, a diverse workforce representative of the communities and customers served, and innovation powered by diversity of thought.

“We appreciate the value of myriad perspectives and the unique experiences each person brings to the fabric of our corporate culture,” one proponent noted.

Among those with existing D&I programs, common key objectives are providing a welcoming environment for all employees, and inclusive hiring and career development practices.

Does Your Organization Currently Have a Diversity & Inclusion Program?

For organizations with programs in their infancy, creating “a safe space” and establishing employee resource groups (ERGs) are priorities. For organizations with programs farther along, priorities are expanding the contributions of existing ERGs while standing up new ones, providing D&I events and activities, and developing clearly defined goals and metrics for their program.

Expanding participation, both at the corporate level and the store level, is also top of mind. The study found that 28% of respondents whose organizations have D&I programs consider themselves very involved, while 37% say they are somewhat involved.

Those who self-identify as non-Caucasian are significantly more likely to indicate that they are very involved (55%) in their company’s D&I program, compared to Caucasians (37%).

Family-owned organizations are significantly more likely to not have a D&I program in place, nor immediate plans to develop one, compared to non-familyowned organizations.

As for the effectiveness of current D&I programs in the industry, high marks are awarded for adhering to inclusive hiring practices, providing a welcoming environment for all employees, ensuring that all employee voices are heard, providing career

Male respondents are significantly more likely than female respondents to agree that their company is very/ extremely e ective at equitable pay practices.

Rate the E ectiveness of Your Organization’s D&I Program (percentage choosing very or extremely effective)

Adheres to inclusive hiring practices

Provides a welcoming environment for all employees

Ensures that all employee voices are heard

Provides career opportunities to all employees for growth and development

Includes equitable pay practices

D&I are not issues our organization is concerned about

Already diverse and inclusive; we don't need a formal D&I program

Our organization doesn't feel it is a corporate responsibility to get involved in D&I issues

Too many higher-priority issues to deal with

Our organization isn't large enough

Having a D&I program would alienate us from our customers and/or business partners

Don't have the organizational structure to support it

D&I detractors

Don't have enough people willing to lead or participate in it

Don't have the budget to support it

Don't know what to do/where to start

“Diversity of ideas matter to us, not color of skin, gender or race.”

— Study participant

development and growth opportunities to all employees, and implementing equitable pay practices.

There does, however, appear to be a gender gap when it comes to equitable pay. Male respondents (72%) are significantly more likely than female respondents (41%) to agree that their company is very/extremely effective at equitable pay practices.

When asked what is preventing their organizations from hitting the goals of their D&I programs, respondents cited not enough employee participation, skepticism among employees and perceptions that D&I efforts are “virtue signaling” as the top barriers.

Those who identify as non-Caucasian are significantly more likely to indicate that a lack of clearly defined goals (34%) and a lack of support from upper management (29%) are substantial barriers, compared to Caucasian respondents (16% and 12%, respectively).

Additionally, the percentage of male respondents who say there are no barriers to reaching D&I program goals is significantly higher than female respondents — 28% vs. 7%.

To overcome the barriers and advance their D&I efforts, c-store industry organizations are planning to expand and enhance their existing programs in various ways. Half of respondents said their organization in the near future will be focusing on

Not enough employee participation

Skepticism among employees/perceptions that D&I efforts are "virtue-signaling"

Lack of visible return on investment

Lack of clearly defined goals

D&I is de-prioritized/not viewed as part of the business strategy

Not enough resources/budget available to support it

Lack of clearly defined metrics to measure performance/progress

Lack of support from upper management/leadership team

Not enough D&I training for employees

Lack of leadership for D&I initiatives/program

collecting feedback from employees on how to improve/expand their D&I program.

“We survey the employees once a year and ask them to rate how much they think the company values diversity and inclusion. The survey also includes options for where we could focus our D&I efforts, as well as places where they can provide suggestions of what they would like to see,” one respondent shared. Another said: “We now include D&I in the corporate survey given to all associates; 17% of the survey is devoted to inclusion and diversity questions about the company performance of the programs.”

Roughly four in 10 respondents said their company’s future plans call for providing D&I training to all employees, prioritizing D&I as part of the business strategy, expanding the focus on mentorship and allyship, and expanding efforts to reach more levels of the organization.

Supporters of diversity and inclusion programs believe that a full commitment is needed for success. They reject the notion that this is only a human resources matter.

“We are proud to be intentional about D&I.

Those who identify as non-Caucasian are significantly more likely to indicate that lack of clearly defined goals and a lack of support from upper management are substantial barriers, compared to Caucasian respondents.

We believe that our efforts will lead to better experiences for our customers, each other and our communities,” one advocate said.

Organizations committed to D&I must incorporate this into their core business strategy and company

Collect feedback from employees on how to improve/expand D&I program

Provide D&I training for all employees

Prioritize D&I as part of the business strategy

Expand focus on mentoring and encouraging allyship

Expand efforts to reach more levels of our organization

Develop/expand ERGs

Expand D&I efforts beyond gender, racial and ethnic lines

Provide educational activities that include store-level employees

Develop clearly defined performance metrics for D&I program

Develop clearly defined goals for D&I program

Establish a D&I committee/council

“If done well, it is not a ‘program,’ it is just part of what we do and ingrained into the culture, strategy and thinking of the organization.”

— Study participant

culture for the best outcomes, according to proponents.

“The goal is for this to just be part of the culture. Prior, it was thought of as a bolt-on experience or a corporate box to check. If done well, it is not a ‘program,’ it is just part of what we do and ingrained into the culture, strategy and thinking of the organization,” one supporter said.

Rather than view diversity and inclusion as an initiative, advocates maintain that it should be viewed as a cultural norm; a lasting way of working, doing business and engaging with communities. D&I should live at the heart of a company’s core values and purpose, they added.

As one proponent put it: “Inclusion and diversity isn't just a program, it's a way of life.” CSN

IN EARLY DECEMBER, British American Tobacco (BAT), parent company of Reynolds American Inc., announced that it would take a hit of around $31.5 billion, writing down the value of some of its U.S. cigarette brands, and acknowledging that its traditional market had no longterm future.

This marked a first in two ways, according to Reuters. It was the first time a major global tobacco firm had written off the value of its traditional cigarette business in a major market and, at the same time, emphasized the need for the industry to focus on alternatives.

RBC Capital Markets analyst James Edwardes Jones said the news exemplifies the "perils of the industry" and sends less confident signals about the outlook for cigarettes.

Similarly, Bonnie Herzog, managing director and senior consumer analyst at Goldman Sachs, called it “a very negative signal on the long-term viability of the cigarette market.”

Convenience store retailers’ expectations for the overall cigarettes category in 2024 are cautious. Nearly half (46%) expect their average per-store sales of cigarettes to decline this year, up 19 points from a year ago. Nearly two-thirds (62%) predict their unit volume will decrease as well, up from 59% last year, according to the findings of the recently released Convenience Store News 2024 Forecast Study

The top factors hurting the cigarettes category, according to c-store retailers, are “never-ending” rising prices, an uncertain regulation space, and an overall decrease in cigarette smokers and associated shift toward alternative products.

“Cigarettes will continue to decline as that customer moves to smokeless, nicotine and e-cigarettes,” one retailer respondent remarked.

In the regulatory space, c-store retailers are particularly concerned about the proposed federal rule that would prohibit the use of menthol in all cigarettes and roll-yourown and heated tobacco products. As of press time, the proposal was with the White House Office of Management and Budget for final review. Menthol cigarettes account for 34% of total c-store cigarette sales.

Goldman Sachs’ “Nicotine Nuggets” survey for the fourth quarter of 2023, representing 67,000 retail locations across the United States, found that cigarette volume declines accelerated sequentially in the quarter, and the same level of deterioration in cigarette volumes is expected this year.

“Accelerated cigarette volume declines are not a new concern, but many retailers are troubled by there being no strong alternative to cigarettes at present, outside of the modern oral category,” Herzog noted.

One segment of the cigarettes category seems to be bucking the trend and that’s fourth tier/deep discount brands. C-store retailers are allocating more space to this segment as they expect trade-down activity to accelerate. For some, this marks the first time they are carving out space in their stores for this segment.

Looking at the subcategories of cigarettes (super premium, premium, discount and deep discount), deep discount is the only price tier that showed any growth in 2023, according to Don Burke, senior vice president of Management Science Associates Inc. (MSA), which specializes in collecting and analyzing tobacco industry sales data.

While premium represents the majority of cigarette sales for most c-store retailers, consumers across the other three price tiers are jumping to deep discount because of the current inflation rate, gas prices, and another interesting reason noted by Burke: government incentives that went to consumers who use tobacco during

the pandemic ended in 2022. “Because of that, we’ve seen a lot of consumers today going to deep discount,” he said. “It’s a trend we think will continue for the next several years.”

Burke also pointed out areas of the country with very distinct differences in top-selling cigarette price tiers. The middle of the country has the strongest representation in deep discount; the eastern part of the country is strongest in discount; the West Coast and New England are strong in premium; and in the South, super premium tends to sell best.

Today’s price-conscious consumers are not staying as brand loyal as they have been historically. They are increasingly making purchase decisions based on what is on promotion. This can even mean poly product use by smokers.

"We remain cautious on the U.S. tobacco/ nicotine industry in the near term as the tobacco consumer remains under substantial financial pressure with many being more selective in their purchases and turning to more affordable alternatives, such as fourth tier/deep discount cigarettes, modern oral tobacco and, increasingly, illicit or gray market disposable vapor products," said Herzog.

Goldman Sachs’ fourth-quarter research found that promotional activity picked up in the quarter led by the oral nicotine and e-cigarette segments as manufacturers invest in promotions to drive conversion and volume.

Convenience store retailers are more optimistic about the other tobacco products (OTP) category than the cigarettes category this year with 56% expecting their average per-store sales of OTP to rise in 2024, a 7-point jump from a year ago, and 53% predicting their unit volume will increase, a 20-point jump from last year. Nearly half of retailer participants in this year’s Forecast Study (48%) said they plan to add more OTP SKUs this year, and 41% plan to devote more square footage to OTP.

The high cost of premium cigarettes, as well as the growing variety of product options available in OTP, are expected to positively impact this category in 2024.

Shifts in category and consumer spending dynamics have been further exacerbated

by flavor ban momentum at the state and federal levels, and uncertainty regarding the future of the e-cigarette category and category innovation as the U.S. Food and Drug Administration is still reviewing premarket tobacco product applications for big market brands, Goldman Sachs noted in its latest “Nicotine Nuggets” survey.

MSA’s Burke points to California’s flavor ban (menthol cigarettes included) that went into effect in December 2022 as a case study for retailers to consider. The firm’s research showed that while cigarettes were down more than twice as much in California as the rest of the U.S. (-14% and -6%, respectively) in the second quarter of 2023, they were down half as much as the rest of the U.S. (-3%) in California’s surrounding states of Oregon, Nevada and Arizona.

“Many of those California consumers traveled to outside the state to get the type of products they want,” Burke explained.

Focusing only on menthol cigarettes for the same period, California was down almost 100% while the rest of the country was down 6.3%. The same surrounding California states were up 10.1% in menthol for the period.

So, the lesson to retailers in states and localities that surround states and localities that put flavor bans in effect is that they should pay attention to and increase their menthol cigarette supply and expect an uptick in sales, according to Burke.

Not all the news was bad for California, however, as it did show an increase in nonmenthol cigarette sales (up 5.3%) during the same period, showing that many consumers who don’t want to travel outside the state will switch to nonmenthol.

For retailers in states and localities that do go through flavor bans, there is opportunity for them to increase their nonmenthol supply of cigarettes, Burke advised. CSN

FOODSERVICE is a huge category for convenience store operators because it offers the opportunity for high margins and more profit to the bottom line.

Many c-store retailers, from single-store operators to large chains, continue to invest in this category with high-end offerings, made-to-order items and proprietary programs. Creating and executing strategic marketing plans are crucial for both awareness and growth in foodservice.

“Foodservice marketing possesses unique characteristics that set it apart from marketing in other categories,” said Philip Santini, senior director of advertising and foodservice at Rutter’s, the York, Pa.based operator of 85 convenience stores.

“It involves appealing to multiple senses, including taste and smell, making

sensory experience pivotal in food purchase decisions. Menus frequently change due to seasonal ingredients, culinary trends and customer preferences, necessitating adaptable marketing strategies,” he explained. “Food holds strong emotional and cultural associations, with marketers often leveraging nostalgia and cultural significance to connect with customers.”

However, even before marketing plans are created and deployed, quality and consistency must be considered or any marketing will not be effective, according to Anita Nelson, president of IN Food Marketing and Design, a full-service advertising agency based in Minneapolis that specializes in the food industry. Retailers need to offer high-quality food and “do everything they can to keep the area clean and the food fresh,” she emphasized.

“Ambiance and service quality are critical in foodservice, creating lasting memories for customers,” echoed Santini. “Operational efficiency is closely tied to foodservice marketing as it must align with the program’s capacity to consistently deliver quality and service as promised.”

Another unique aspect of foodservice marketing is the ability for retailers to capture multiple visits a day by customers by daypart, whether it’s a breakfast sandwich in the morning, a made-toorder sub at lunch or a take-home meal for dinner. Retailers can capitalize on the various dayparts by targeting radio and mobile ads around what they offer, Nelson said.

“The category also offers the opportunity for retailers to upsell by pairing other in-store items with foodservice items, such as chips and beverages,” she added.

When spreading the word about foodservice offerings, begin with existing store customers, either encouraging them to add an item to their existing basket or visit during a new daypart, advised Ed Burcher, a partner at Business Accelerator Team, based in Phoenix.

“One of the first things to increase sales and profits is getting people to come more often, which is absolutely easier than getting someone in who doesn’t use the store,” he noted. “Know your customer and offer digital coupons or sampling of lunch during breakfast.”

Finding a marketing strategy that works for c-store foodservice depends on a number of factors and can differ depending on the store, location and demographic. Retailers must know who their customers are and the characteristics of the local communities their store serves in order to create a marketing program that works, according to Burcher.

“I’ve seen many parts of the country and many different offers, and I wish there was a silver bullet, but it depends on where you are located, who you are competing with and who you are marketing to,” he said. “In the MidAtlantic, outdoor events are a wonderful way to make people aware of your offering. In other parts of the country, this doesn’t exist and billboards are the way to go. In some cases, print and newspapers are still the best option. From old school to digital, all of them can work, but you need to understand your market.”

Getting people aware of the offerings and then getting them to try them are the first steps of any good foodservice marketing strategy, said Burcher. It should be based on a customer’s journey and could include a highway billboard, pumptoppers, video at the pump or clings on the store windows.

“It’s about communicating why your product is better, new or different,” he said. “The main foodservice competitor for c-stores is the QSR [quick-service

restaurant], and c-stores should be looking at what they are doing. They have not completely abandoned mail flyers, for example, so look at what they are doing in your market and emulate it.”

Additionally, when it comes to marketing foodservice items, eliciting an emotional response is key to attracting customers, which is why Burcher is a proponent of in-store sampling. Similar to when a large brand such as Hershey’s or Frito-Lay launches a new item and puts money behind it to gain awareness — and the c-store becomes an avenue for trial of that product — this should be done with new food items as well, he urged.

“Offering samples and interacting with the customers are great options, especially for newly launched items, whether limited-time offers, a new flavor or a new breakfast sandwich,” Burcher explained.

In addition to sampling, using high-quality photos on all marketing materials, social media and in-store menus is important to convey the quality of an item, as well as elicit the emotional response needed for people to crave an item, Nelson said.

“Appetite appeal is huge, so investing in professional images is better than having an entire library of low-quality ones, and the food experience needs to match the marketing,” she said, noting that the QSR space does a great job with limited-time offers and keeping their menus fresh to drive traffic — something many c-stores are now doing as well.

Rutter’s introduces limited-time offers every quarter. For example, in July 2023, the chain introduced Kickin’ Chicken and Waffles, the Donut Breakfast, and Grilled Mac and Cheese. In October, the retailer launched the Hangover Burger, Mexican Pizza and Loaded Pierogies.

“Introducing limited-time offers is a way for Rutter’s to regularly unveil fresh and captivating dishes, and keep customers engaged and eager to return for these limited-time delights,” Santini said, noting that they are often linked to seasons, holidays or special occasions. “The limited time nature of these items instills a sense of urgency, compelling customers to savor them before they vanish from the menu, ultimately boosting sales during the promotional period.”

Offering a limited-time item can also

When marketing their foodservice programs, convenience store retailers must know who their customers are, provide high-quality food items on a consistent basis and reach out to customers in ways that work for their market and demographic.

“Many marketers can complicate the basic principles of marketing,” said Philip Santini, senior director of advertising and foodservice for Rutter’s. “For us, it starts with understanding our loyal customers, our in-store operators and the metrics we use to measure product success. When we introduce new menu items or review existing ones, our primary focus is always on our customers. We consistently ask ourselves what aligns with their preferences and then work on effective marketing strategies accordingly.”

When a retailer is offering high-quality food items, a clean environment and freshly made offerings, it’s important to convey this message to consumers. At the same time, many c-store chains are tying foodservice promotions into their loyalty program to draw in customers already visiting their stores.

“At Rutter’s, marketing our products is straightforward because we invest in quality ingredients and employ careful food preparation methods,” Santini said. “We enhance customer engagement through promotions and limited-time offerings, all while maintaining a strong loyalty program that rewards regular customers with discounts, free items and exclusive benefits. These efforts aim to keep customers interested and coming back.”

Rutter’s surveys its customers to get feedback on their order satisfaction so that the retailer can monitor what’s working and where it can improve. Customers who use its mobile app or online ordering option receive a brief survey to gauge order satisfaction.

“With this valuable feedback, we adjust and refine our foodservice offerings and marketing strategies to better serve our guests,” Santini explained.

When quality and consistency are part of a foodservice program, customers will not only come back, but they’ll also share their experience with others, drawing in new people, according to Anita Nelson, president of IN Food Marketing and Design.

“In our market, Kwik Trip amped up its foodservice program in the last five years and it garnered a lot of word-of-mouth,” she cited. “I heard from my brother how he loved going there for lunch and then started hearing the same thing from others. [Kwik Trip] also does a great job appealing to a variety of demographics, including healthy options for women along with pizza and roller grill items.”

“O ering samples and interacting with the customers are great options, especially for newly launched items, whether limited-time o ers, a new flavor or a new breakfast sandwich.”

— Ed Burcher, Business Accelerator Team

serve as a test for a new product that may eventually become a permanent menu item depending on demand, he pointed out.

The key to marketing these items is “a concise and engaging message” that highlights key details such as what the offer is, why it’s unique and when it will be available, according to Santini. From there, Rutter’s creates promotional materials such as kiosk images, videos for its in-store television displays, and social media images and copy.

Putting forth promotions and deals on foodservice items — particularly new introductions — is another way to drive sales in this category, whether it’s launching a new breakfast sandwich for $1 or offering a free item with a purchase, said Burcher.

“Presenting exclusive promotions on a curated range of our bestselling food items has proven to be a highly effective strategy for spotlighting our foodservice program,” Santini echoed, pointing to Rutter’s loyalty program as a vehicle for this as well. “The introduction of our loyalty program adds an extra layer of motivation for customers to frequent our establishment regularly, offering enticing incentives such as discounts and fuel rewards.”

Nelson cautions retailers to remember that marketing shouldn’t just be limited to in-store.

“A lot of c-stores do a great job with in-store marketing but don’t do enough outside the store, including billboards, digital, print, mobile ads and radio. They have to remember they are competing with QSRs,” she said. “Also, social media can be a really important tactic for c-store retailers to use and it’s a great way to keep their offerings top of mind.” CSN

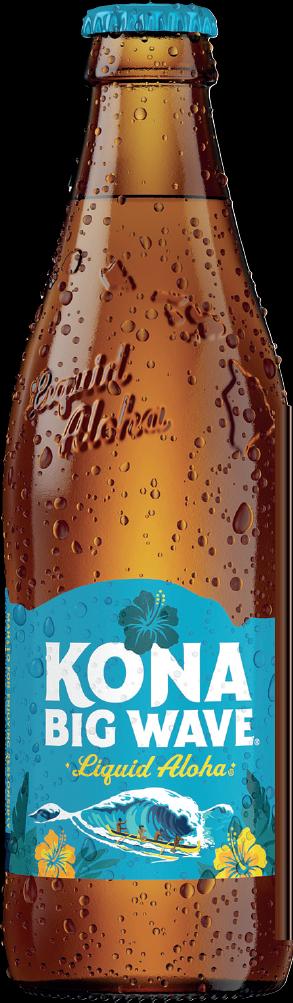

FOR SOME CONVENIENCE store retailers, the beer and malt beverages section of the cold vault is a set-it-and-forget-it area of the store that only requires them to stock the most popular brands in order get sales they deem good enough.

Savvy c-store retailers, however, are taking steps to leverage the channel’s advantages and set themselves apart in the category, going from good enough to great.

When it comes to alcoholic beverage sales, size matters. With the exception of the very biggest store formats, c-store operators are limited in the number of alcoholic beverage types and brands they can stock in their cold vault. Compared to a supermarket that can sell beer or an alcoholic beverage specialty store, it’s unlikely a c-store can match up in SKU count — but even consumers who love sampling new brews value the ability to make a quick trip some days.

“Convenience stores are just that: convenient. Instead of walking all the way to the alcohol aisle in a grocery store and waiting in a long line to check out

or heading to the liquor store where the items sold are very niche, you can have all your needs met at c-stores. Especially if you’re on the way to an event, heading to the lake or simply just need to make a quick stop,” said Kevin Smartt, CEO of Spicewood, Texas-based Texas Born (TXB) convenience stores.

During the COVID-19 pandemic, consumers embraced alternative alcohol-purchase methods, but shopping habits are changing again in a post-pandemic world. The Uber-owned Drizly delivery service saw sales jump around 350% in 2020, yet ceased operations as an independent app in March.

The packaged alcoholic beverage market is expanding with ready-to-drink (RTD) cocktails, seasonal brews and nonalcoholic beers generating buzz. C-stores have an opportunity to establish themselves in customers’ minds as the destination for alcoholic beverage purchases.

To seize this opportunity, convenience stores that sell beer and malt beverages should focus on what they can do better than competing retailers.

For Ankeny, Iowa-based Casey’s General Stores Inc., this meant creating a brand-new role at the company: Chief Pizza & Beer Officer. Last fall, the retailer trademarked itself as The Official Pizza and Beer Headquarters.

“We take a lot of pride in that,” said Tom Brennan, chief merchandising officer at Casey’s, which operates more than 2,500 c-stores.

He noted that the role was inspired by discussions among the Casey’s team on how to spread the word and engage the chain’s guest base on the “best combination ever” of its proprietary, handmade pizza and variety of beer for sale.

The hiring campaign, which drew 500 candidates and resulted in the selection of Joe Cruz from Lincoln, Neb., generated plenty of buzz, but wasn’t just a marketing stunt. Cruz will contribute to initiatives that drive trial and boost sales of both alcoholic beverages and foodservice.

“One of the key tasks that we’re challenging our pizza and beer officer with is coming up with some recommended pairings, perhaps ones that maybe people haven’t considered,” Brennan said. “Maybe they’ll discover something new in terms of what they like.”

While not all c-store chains have Casey’s 17-state reach, operators should consider what unique strengths they can bring to the table in terms of alcohol offerings. For Pennsylvania-based chains Rutter’s and Sheetz Inc., such efforts have included extending their private label offerings. In recent years, both chains have teamed up with regional brewers to create their own limited-edition beers: Rutter’s Chocolate Milk Stout, made with Lancaster Brewing Co., and Sheetz’s Project Happy Holeidayz, a deep golden pale ale made by Asheville, N.C.-based Wicked Weed Brewing Co. using the retailer’s Shweetz Glazed Vanilla Donut Holes.

Casey’s also has teamed up with Buffalo Trace Distillery on a limited-time offer. Buffalo Trace Single Barrel Select Bourbon returned for the third year in 2024 at 73 locations.

Along with building up their assortment and reputation, it is vital that c-stores keep up with the latest product trends. Two years ago, the hard seltzer segment was heating up. Today, seltzer sales are slumping, a change driven in part by the rise of RTD cocktails. There’s also been renewed interest in light lager, which competes closely with hard seltzer, according to category research from Drizly and BevAlc Insights.

“We are seeing a shift from low-calorie to more full-flavored, higher-sugar malt beverages,” said TXB’s Smartt, noting that the chain’s overall alcoholic beverage sales are trending up.

It’s also worth making space for craft beer alongside the popular national brands. While its once-meteoric growth began to slow as the segment matured and microbreweries jockeyed for space on crowded shelves, retailers say they still see good results from craft beer.

“Craft is still growing for us year after year. We typically see better craft sales in higher-income areas and markets closer to larger cities. Space for the different segments is determined by sales per location,” Smartt said. “Being spread out across Texas and southern Oklahoma, we have a pretty diverse customer base, dictating how we market and allocate space for beer and wine.”

Numerous market researchers predict that local will be a significant trend in 2024, particularly among the younger generations who care about sustainability in their communities and jump on the chance to sample new offerings. C-stores that establish themselves as a source for variety in beer and other alcoholic beverages can give these consumers a reason to make return visits.

“One thing that’s really interesting about the beer category is certainly there’s a very strong presence among the national brands, but then there’s been a craft beer revolution that’s occurred over the last several years. And with that, you have a lot of localization that’s happening where you’ve got your local regional craft brewers that certainly will have a presence in the set,” said Brennan.

Additionally, while the cold vault isn’t typically viewed as a technology-centric area of the store, convenience retailers should consider how they can incorporate age-verified products into their digital ordering tools. New solutions such as NACS’ TruAge digital age-verification tool and artificial intelligence facial recognition solutions are starting to be deployed at cashier-free locations and enable c-stores to make a shopping trip for alcohol as convenient as any other trip.

At TXB, “you can fill up your tank, get quality, healthy meals and snacks, pick up alcohol and be on your way in record time,” said Smartt. “Convenience stores should always focus on making the experience as efficient as possible for guests.” CSN

MARCH

INSIDE JAVA EVOLUTION P. S10

PROMOTING PRIVATE LABEL P. S14

SpartanNash takes its private label assortment upscale with the launch of Finest Reserve

Ask Rick Weekley about SpartanNash’s newest private label line, Finest Reserve, and he’s not shy about expressing his excitement.

“I’m starting my 37th year in this industry, and I don’t recall ever having anything that I’ve been as excited about and proud to be a part of,” asserts Weekly, the senior director of creative services and own brands marketing for Grand Rapids, Mich.-based SpartanNash. “It has been a wonderful journey, and we’re just at the beginning of the potential for what we’re doing with Finest Reserve.”

Building off the company’s long history of success with its Our Family private label assortment, Finest Reserve — to steal a line from Chef Emeril Lagasse — kicks it up a notch. Positioned as a premium line, the brand’s initial assortment includes frozen pizza; frozen pasta; sauces, dressings and marinades; premium spices, salts and seasoning blends; and premium chocolates. Wine is also being added to the line, marking the first time that SpartanNash has waded into the wine and spirits category.

This upscale assortment, which is proprietary to SpartanNash and its retailers, could serve as a benchmark for retailers that are looking to evolve their private label assortments. While the history of store-brand products has been to offer consumers lowerpriced alternatives to national brands, retailers are now seeing the opportunity to present premium high-value products that can’t be found at their competitors.

In an interview with Store Brands, Weekly discussed the development of Finest Reserve, the initial response from consumers and the role that this upscale line could play in keeping sales of private label products growing.

Some things simply go together - for good reason. By delivering quality private label paper products, at the best price, when and where they’re needed, our customers confidently trust us with their label. Just ask and we’ll put it on paper!

•Full range of ultra, premium, FSC® Certifi ed, recycled, and traditional paper grades

• Paper towels, bath tissue, napkins, and facial tissues

• Flexible, custom manufacturing, packaging and displays

• For lower volumes we offer our pre-packaged Azure® Ultra Premium, Daisy®, Delicate Touch®, and Earth One™ store brands.

STORE BRANDS: What were some of the key factors that led to the development of Finest Reserve?

RICK WEEKLY: Turning back the clock a couple of years, SpartanNash was re-energized following a leadership change, and we were making the transformation from traditional wholesale supplier to truly being a customer-centric food solutions provider. The key phrase there is “customer-centric,” especially as we were coming out of the pandemic and consumers were returning to normal. One of the things we explored was our privatebrand program. We did extensive consumer research to understand how the brands were being perceived and if they were meeting the needs of shoppers.

SB: What were some of the key findings from that research?

RW: There were some valuable learnings from our research, one of which was that we had a void in our own brand’s architecture. We had an opening-price-point brand solution and a mainstream brand solution for center store. What was missing was a premium offering. And if you recall during the pandemic, indulgence was still something that people were unwilling to sacrifice, and we knew that was a longer-term trend. That was really the genesis of the process. Our consumer research then went into brand, brand mark creation, naming and then more contact with the consumer to validate the direction. We needed to know the message we intended to have was connecting with consumers.

SB: What led to the selection of the initial products in the Finest Reserve assortment?

RW: This goes back to our customer-centric approach. We started with consumer research to identify what the needs of the premium shopper are. The main thing we found out was they are not willing to sacrifice on quality to get a lower price. And categories such as wine and spirits and chocolate are very much at the top of their list.

I’m starting my 37th year in this industry, and I don’t recall ever having anything that I’ve been as excited about and proud to be a part of. It has been a wonderful journey, and we’re just at the beginning of the potential for what we’re doing with Finest Reserve.

—Rick Weekly, SpartanNash

So we went after the most obvious choices based on that research.

SB: While the line is still in its early stages, has there been an evolution in the time it’s been available?

RW: One of the most exciting parts of my job is every day, I get to walk into the world of Finest Reserve and know that I’m a part of a constantly evolving universe. There is a storytelling aspect to the brand as we work to get the brand top of mind for consumers. With our packaging, for example, we wanted to be very tactile in our approach. We have opportunities to do things such as embossing, textured background or foil sampling. We want this to feel good, taste good and look good when sitting on the kitchen counter at home. Additionally, our storytelling with Finest Reserve is very video-based. We are investing heavily in creative production for digital outlets, be it streaming services, traditional broadcast media and every social application to where we can take the customer on that journey. That story is evolving as the brand continues to grow.

SB: What are the differences in terms of product selection and product development between Finest Reserve and the broader Our Family assortment?

RW: The Our Family brand is celebrating its 120th anniversary, and I believe is one of the oldest private brands in existence in the U.S. So there is a tremendous amount of trust with that brand. When we started talking about a premium brand, we wanted to have the Our Family endorsement be a key element in that journey. This is why we went with Finest Reserve by Our Family. We wanted to have that connection.

When we do item selection and product development, there’s some common criteria for evaluation. It may have to do with flavor profiles, manufacturing standards and so on. While there’s a parallel for the first part of the journey, Finest Reserve then starts branching off. It’s less about the price; the brand is about delivering the experience first. That’s why we went to Italy to find authentic hand-stretched artisan pizzas and other products that offer unique flavor profiles. We also make sure the products are able to deliver a better experience.

SB: Since Finest Reserve offers premium products, how are the features and benefits of the products communicated to consumers?

RW: It goes back to our ability to tell a story and using video and digital tools to drive brand awareness. There is also a journey that includes product packaging, signage on shelf that supports the story and educates shoppers, and use of media to connect with shoppers on various digital platforms. We want to give consumers an emotional connection to the brand.

SB: Early on, what have been some of the big sellers from Finest Reserve?

RW: The chocolates have been huge right out of the gate. We went out with some aggressive price points, introduced digital coupons and did in-store sampling. We want the consumer to feel as if they’re getting a good value as we get them to try this new brand. Our spices have also been steady performers as well. Other products, including the sauces, pizzas and pastas, are just hitting the shelves now. Out of the gate, we have received some favorable responses, and we are focused on keeping that momentum going.

SB: Will offerings such as Finest Reserve serve to help continue improving consumer perceptions of store-brand products?

RW: I really think so. We need to have a national-brand mindset when we’re presenting a premium product. In the “old days,” the approach with private label products was either we were going to emulate products already on the shelves or take a minimalistic approach. Now, we can’t do that. We know consumers today are more accepting of private brands than ever before, but these products shouldn’t feel like a sacrifice. We did research that indicates things such as packaging perception drive consumer perception regarding the quality that’s inside. As a result, we had to elevate how the product looked on shelf. We want to give the consumer an elevated experience, but also let them know they can save a little money at the same time. I think that’s really important in shaping the future of the private-brand journey.

SB: With the growth seen in private label in recent years, have we reached a point where either retailers or consumers are offering their thoughts on new products they would like to see?

RW: Being a wholesaler and a retailer is a tremendous advantage for SpartanNash. We receive a tremendous amount of data from our stores that are customer-specific to their preferences and desires for product expansion. They’re voting with their wallets. Additionally, social media has been a tremendous asset to us, not just for storytelling, but also receiving feedback from consumers about what they think about our products, and also what they would like to see

These artisan-crafted pizzas are prepared using a wood-fired, hand-stretched crust and fresh, authentic mozzarella cheese from Italy. The selection consists of Margherita & Basil, Roasted Vegetable, Pepperoni & Spicy Honey, and Spinach & Goat Cheese.

These selections put a twist on a variety of pasta favorites, with all items imported from Italy. The line’s flavors are Ricotta & Spinach Big Tortellini; Eggplant Parmesan Big Girasoli; Porcini Mushroom Ravioli; and Tomato, Mozzarella and Basil Girasoli.

developed. Once you’ve built that relationship [with consumers], they’re not shy. We have also used our social media channels to test packaging concepts to see what our customers respond to the best.

SB: We’re seeing improved consumer perception of private label products. How does this change the product development approach at SpartanNash?

RW: It gives us the confidence to stretch a little bit more than we have previously. We know consumers are now understanding what we are delivering through our private brands. As a result, innovation is now something we embrace rather than fear. In the past, launching a premium private label line would have been a more difficult conversation. Now, this change in perception of private label products has allowed us to remove the internal barriers we may have created for ourselves.

SB: Are there plans for further expansion of Finest Reserve, and, if so, what categories may be added?

RW: The launch has been very successful, and there will be growth and expansion in the future. We’ll be introducing coffee very soon, and we’re going back to Italy for imported dried pastas and pasta sauces. We’re also looking at some specialty condiment areas like specialty mustards and things of that nature. The brand has filled a very important need, not only for the consumer, but also for the retailers that carry our products. Growth is the word at SpartanNash, and that certainly resonates through the Finest Reserve brand. There’s no stopping us now!

A set of eight flavors makes up this assortment of sauces and marinades. They are Sweet Mesquite Molasses, Honey Habanero, Tangy Carolina, Vidalia Onion, Tangy Mustard, Asian Honey, Kentucky Bourbon and Carolina Smokehouse. Salad dressing selections are Vidalia Onion & Peppercorn, Creamy Cucumber Dill, Extra Virgin Italian, and Raspberry Vinaigrette.

Consumers are able to stock their cupboards with this assortment of more than 25 spices, salts and blends. The line’s broad variety includes Garam Masala, Black Truffle Salt, Garlic Powder, Cinnamon, Turmeric, Ground Ginger and Black Peppercorn.

More than a dozen unique selections comprise the Finest Reserve Chocolate assortment. Featured among them are Sea Salt Milk Chocolate Caramels, Mint Chocolate

Chip Cookie Bites, Peanut Butter Chocolate Caramels, Chocolate Raspberry Cremes and Milk Chocolate Coconut Almonds.

When southern Italy-based La Doria acquired a historic Italian manufacturer of ready-made sauces in 2014, the company became the first Italian manufacturer of ready-made sauces under private label. It also became one of the leading manufacturers in Europe, thanks to two plants located in regions at the heart of Italy’s culinary heritage: Parma in Emilia-Romagna and Campania, in Sarno.

That acquisition has enabled La Doria to invest in research and development initiatives that have led to the development of the kind of high-quality, innovative private sauces today’s consumers are demanding.

“When it comes to sauces, consumers are increasingly looking for high-quality, ready-made products made with safe ingredients of guaranteed origin — products that combine taste with well-being, with clean recipes, without flavorings, preservatives or colorings,” says Diodato Ferraioli, Chief Commercial Officer of La Doria. “Organic food is also a fast-growing segment, thanks in part to the strong presence of private labels, as are vegan and vegetarian offerings.”

Consumers are looking for and finding that quality in private label products.